Please pay your December 2025 taxes to your Local Municipal Treasurer (Town, Village, or City) through the January 31 due date. Mailing instructions are on your tax bill.

Please do not wait until the last days to pay in case there are any problems that can be reconciled before the due date. The cost of going delinquent is severe:

If you have a question about your tax bill, please contact your local municipal treasurer (see the County Directory).

Please provide a separate check/payment to Dane County for delinquent taxes.

Three ways to pay Dane County:

1. Pay by mail with a check payable to...

Dane County Treasurer

PO Box 1299

Madison, WI 53701-1299

2. Pay with cash, check, or money order at the City-County Building (office or drop box)

210 Martin Luther King Jr Blvd, Rm 114

Madison, WI 53703

Office Hours 8:00 - 4:00 (M-F), excluding holidays

3. Pay online with a credit card or e-Check. Please note,

Additional property information is available on Access Dane. For specific tax questions, please contact the Treasurer's Office at treasurer@danecounty.gov, and we will further assist you.

Mail your payment early to make sure the U.S. Postal Service postmark is timely. Please know that it can take up to fourteen days to identify and resolve an online payment error, a check mailed to the wrong address, or an insufficient funds payment.

Dane County is collecting real estate property tax for all years, except 2025 for City of Madison (see below).

Three ways to pay Dane County:

1. Pay by mail with a check payable to…

Dane County Treasurer

PO Box 1299

Madison, WI 53701-1299

2. Pay with cash, check, or money order at the City County Building (office or drop box)

210 Martin Luther King Jr Blvd, Rm 114

Madison, WI 53703

Office Hours 8:00 - 4:00 (M-F), excluding holidays

3. Pay online with a credit card or e-Check. Please note,

Additional property information is available on Access Dane. For specific tax questions, please contact the Treasurer's Office at treasurer@danecounty.gov, and we will further assist you.

Mail your payment early to make sure the U.S. Postal Service postmark is timely. Please know that it can take up to fourteen days to identify and resolve an online payment error, a check mailed to the wrong address, or an insufficient funds payment.

If you owe 2025 taxes to City of Madison, please mail that payment directly to the City in a separate envelope with a separate check. For more information regarding the City of Madison due dates and current tax year amounts due, please contact the City of Madison Treasurer:

City of Madison Treasurer

City-County Building

210 Martin Luther King Jr Blvd, Rm 107

Madison, WI 53703-3342

608-266-4771

treasury@cityofmadison.com

www.cityofmadison.com/treasurer

Three ways to pay Dane County:

1. Pay by mail with a check payable to...

Dane County Treasurer

PO Box 1299

Madison, WI 53701-1299

2. Pay with cash, check, or money order at the City-County Building (office or drop box)

210 Martin Luther King Jr Blvd, Rm 114

Madison, WI 53703

Office Hours 8:00 - 4:00 (M-F), excluding holidays

3. Pay online with a credit card or e-Check. Please note,

Additional property information is available on Access Dane. For specific tax questions, please contact the Treasurer's Office at treasurer@danecounty.gov, and we will further assist you.

Mail your payment early to make sure the U.S. Postal Service postmark is timely. Please know that it can take up to fourteen days to identify and resolve an online payment error, a check mailed to the wrong address, or an insufficient funds payment.

Property addresses and Billing addresses are handled through Dane County Property Listing. When a property is transferred (bought & sold), normal documents submitted to the Register of Deeds should automatically update the billing address.

If the billing address is incorrect, you have the following 2 options:

1. Contact Municipal Clerk or Treasurer

Your local Clerk can help with a billing address update. Contact the clerk where you live, they can submit an electronic update online for you. You can find their contact information here: The Official Dane County Directory

2. Direct Owner Requests

Requests made by the property owner to update a billing address will need to be made in writing to:

Dane County Planning & Development

Attention: Property Listing

210 Martin Luther King Jr. Blvd Room 116

Madison WI 53703

Please include:

Email requests with all the above information will also be accepted if addressed to property.listing@danecounty.gov

How Do I Find My Parcel Number?

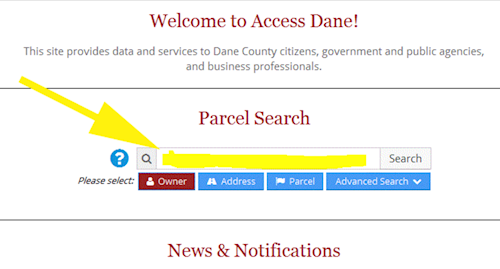

Your parcel number is included on your property tax bill. Another way to find it is by doing a Parcel Search on the AccessDane website. Choose a search method, enter appropriate information and the search results page will show your parcel number.

If you would like the property tax records to reflect a change of name, you may need to record documentation with the Register of Deeds office. We encourage consultation with appropriate legal authorities.

Death of a Spouse

If you are requesting that a name be removed due to the death of a spouse, you must record either a "Final Judgement" or a "Termination of Decedent's Interest" form depending on how title was held. You can determine how title was held by looking at your deed.

If you held title as "joint tenancy" or "survivorship marital property", you need to record a "Termination of Decedent's Interest" form. You can obtain forms needed at the Register of Deeds Office along with instructions on how to fill them out. The phone number for the Register of Deeds is (608) 266-4141.

If you held title as "tenants in common", Termination of Decedent's Interest cannot be used. In this case you probably need to record the "Final Judgement". You may wish to consult your attorney first to see if this has already been done.

Marriage

If you wish to change the last name due to a marriage, we can add your new name to what is already on the record, but we cannot remove the name that is reflected on your deed without a new deed being recorded. It is possible to obtain a copy of a Quit Claim Deed from most business supply stores. After this is filled out, take it to the Register of Deeds office to be recorded. You will also need to fill out an electronic Wisconsin Real Estate Transfer Return (eRETR).

For information on recording fees, contact the Register of Deeds at (608) 266-4141.

Divorce

If you wish to change a name, or remove a name, due to divorce, you must have a Quit Claim Deed or Final Judgement recorded in the register of Deeds Office. In cases where you are resuming use of a maiden name you need to make sure the Quit Claim Deed reflects this change. Quite often the deed is made out in the married name. In most cases one of these documents already exists. However, sometimes these documents are not recorded and no change can be completed until they are recorded at the Register of Deeds office.

If one of these documents has been recorded and Dane County has not changed the records, please let us know as soon as possible. Please include information about the documents such as the date recorded or the document number.

How to Submit Your Request

Dane County Planning & Development

Attention: Property Listing

210 Martin Luther King Jr. Blvd Room 116

Madison, WI 53703

These requests are not taken by phone.

Per State Statute 74.69(1), property tax payments are considered timely:

Timely payment is determined by the postmark affixed by the US Postal Service. According to the USPS, a postmark is NOT added the same day payment is placed in the mail. Paying in-person at the Treasurer's office or via e-Check on the Treasurer's website is a better option when paying near a due date.

IF Paying Online Through Your Bank:

If an installment amount is not paid by the due date listed on the tax bill, taxes become delinquent:

Payments take time to process. Access Dane is updated each night with payments that have been entered into the tax collection system.

If your payment does not show online, please email treasurer@danecounty.gov to see whether your payment was received.

Linked below is all the information available on Dane County tax deed auctions:

https://treasurer.danecounty.gov/taxdeedauction

Unclaimed Funds data extractions are $110 per request. This must be pre-paid.

The below criteria are needed in your request to get you exactly the information you are needing from what is available:

Send payment and the above information to:

Dane County Treasurer

PO Box 1299

Madison, WI 53701-1299