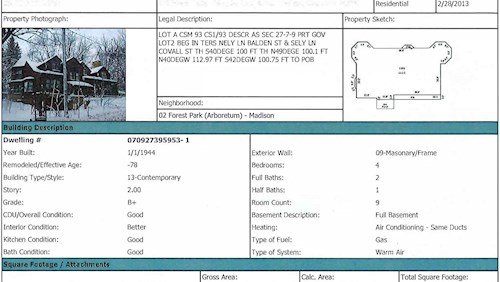

The value a local municipal assessor places on property to establish the proportional relationship of tax burden between properties within a municipality

Wisconsin Department of Revenue (publications)

January 1: Municipal Assessor determines property values

Spring/Summer: Municipal Open Book & Board of Review

The calendar year in which January 1 assessments are determined and December tax bills are prepared with due dates the following calendar year

Basic calculation:

Collection statistics:

Timely payment is determined by the postmark affixed by the US Postal Service. According to the USPS, a postmark is NOT added the same day payment is placed in the mail. Paying in-person at the Treasurer's office or via e-Check on the Treasurer's website is a better option when paying near a due date.

IF Paying Online Through Your Bank:

If at least the installment amount is not paid by the due date listed on the tax bill and the taxes become delinquent, the following occurs:

Please note: No payment is considered valid until it clears all banks. Should a payment be returned by the bank for any reason, all bills covered by the payment will be cancelled and all receipts voided. Additional interest and penalty may accrue.

*The City of Madison has intermediate installments, and payments for properties within the City of Madison are collected by the City Treasurer through the July 31 due date. Information regarding City of Madison due dates and amounts for the current tax year can be obtained by contacting the City of Madison Treasurer:

City of Madison Treasurer

City-County Building

210 Martin Luther King Jr Blvd, Rm 107

Madison, WI 53703-3342

(608) 266-4771

treasury@cityofmadison.com

City of Madison Treasurer's Website